CASE BACKGROUND:

In the early 2010s, I spent most of my earnings purchasing hundreds of bitcoins. I eventually deposited them at BlockFi, Genesis, Celsius, Voyager, FTX, and related companies. These companies were all scams, with most CEOs, such as SBF, Alex Mashinsky, and Barry Silbert either convicted, on trial, or under investigation.

After the companies failed, I decided to exit the cryptocurrency industry by selling the remaining coins I had in my possession as well as the bankruptcy claims for a large loss.

The first deposit (see https://restructuring.ra.kroll.com/genesis/, docket #50) from these sales was sent to my Wells Fargo accounts in February 2023.

When the initial million dollars arrived at the account, Gail Macker Carlino of Seashore Wealth Management (https://seashorewm.com), a Wells Fargo associate, told me that Wells Fargo was investigating my cryptocurrency involvement.

On March 12, 2023, she notified me that Wells Fargo closed 13 accounts owned by me, my brother, my businesses, my brother's business, my friends' business, and four credit card accounts.

Wells Fargo attempted to charge additional cancellation fees to me which I negotiated successfully to get dismissed.

One of the credit card accounts contained hundreds of dollars of Active Cash rewards points which had been earned through a promotional program they had advertised and which was the only reason I signed up for that card.

Wells Fargo seized the rewards points, claiming that when an account is closed for any reason, the rewards points are forfeit.

I paid the balance on the card for the valid purchases - except for the value of the rewards points - and notified Wells Fargo the remaining debt was invalid.

Wells Fargo charged off the debt and reported to credit agencies, dropping my credit score from approximately 780 to approximately 615.

I sent multiple demand letters to Wells Fargo offering a settlement and they declined.

See previous discussion: /SteveSokolowski/will-wells-fargo-sue-me

CAUSES OF ACTION:

Damages amount: $4,839.30 - the difference between 15 months of 22.24% APR and 0% APR, because I could not be approved to roll over this debt to a 0% APR card. I would have been approved if Wells Fargo had not reduced my credit score. Additionally requested $2,500 in damages in case primary damages are reduced - a conservative machine learning engineer salary of $125/hr for 20 hours of labor. Requested jurisdictional maximum of $12,000.

There are multiple causes of action listed, so that damages can still be awarded even if the judge finds one or two theories invalid:

False advertising: the Pennsylvania Unfair Trade Practices and Consumer Protection Law provides for treble damages. Wells Fargo's advertising at https://creditcards.wellsfargo.com/active-cash-credit-card, which I relied upon, does not mention in a prominent position that the company may forfeit rewards unilaterally.

Negligent credit reporting: the Fair Credit Reporting Act (FCRA, 15 U.S.C. § 1681s-2) provides for penalties in the case that a person reports an inaccurate debt. The debt for the rewards points value was not valid and should not have been reported.

Unconscionable contract: by common law, this contract shocks the conscience. It is fundamentally unfair for a contract to be able to be ended by one side. The fact that many other banks engage in similar credit card contracts, leading to a lack of consumer choice and prohibiting me from selecting another bank, supports this argument.

OTHER NOTES:

I will not sign any settlement which contains a non-disparagement clause.

The mess I find myself in while attempting to turn the page out of cryptocurrencies (and an unrelated fraud case) has resulted in a 100% winrate so far in small claims cases mostly dealing with account freezes; I received awards against Angi, the City of Tallahassee, Coinbase, and Block Inc.

There is a mandatory arbitration clause which still allows litigation in small claims court, which is why I pursued this venue.

Unlike the previous market, now that litigation has commenced I will only post information available to the public (such as court orders) as updates; I will not discuss legal strategy or reveal any communications with Wells Fargo.

In my experience, small claims cases like this are usually settled within two months, or by October 2024.

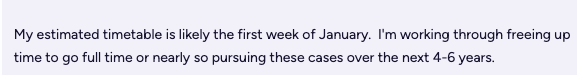

CASE FILING:

RESOLUTION:

The market will resolve to YES if:

A judge awards a non-trivial amount to me for any reason

The judge orders the credit file expunged of Wells Fargo's reports

A settlement of a non-trivial amount is reached, even if the settlement amount is bound by a non-disclosure agreement.

The market will resolve to NO if:

The case is dismissed with prejudice

Litigation permanently terminates without an award or settlement

I die and the executor of my estate chooses not to continue the case

UPDATES:

2024-08-29: Pennsylvania apparently has a "tiered" system for court fees. The previous case was rejected because I paid the same amount as it cost to sue Coinbase. This case is requesting larger damages, and the filing was rejected. I mailed a new form that is identical to the old one, with the amount changed to be around $210 instead, along with their rejection note and requested for it to be refiled. This is expected to cause a 7 day delay but has no impact on the case's disposition.

2024-09-06:

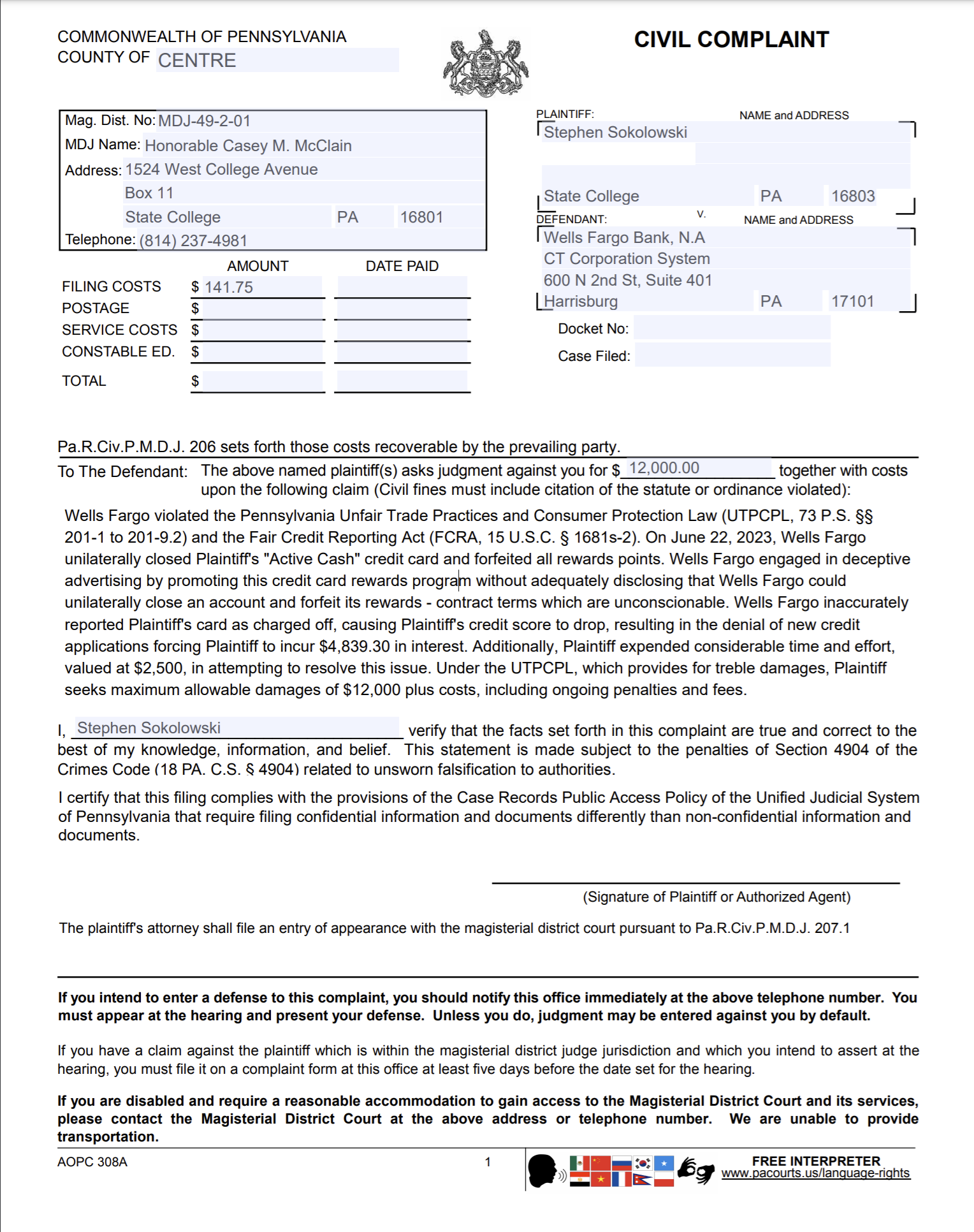

These papers are self-explanatory and show the hearing dates.

2024-09-12:

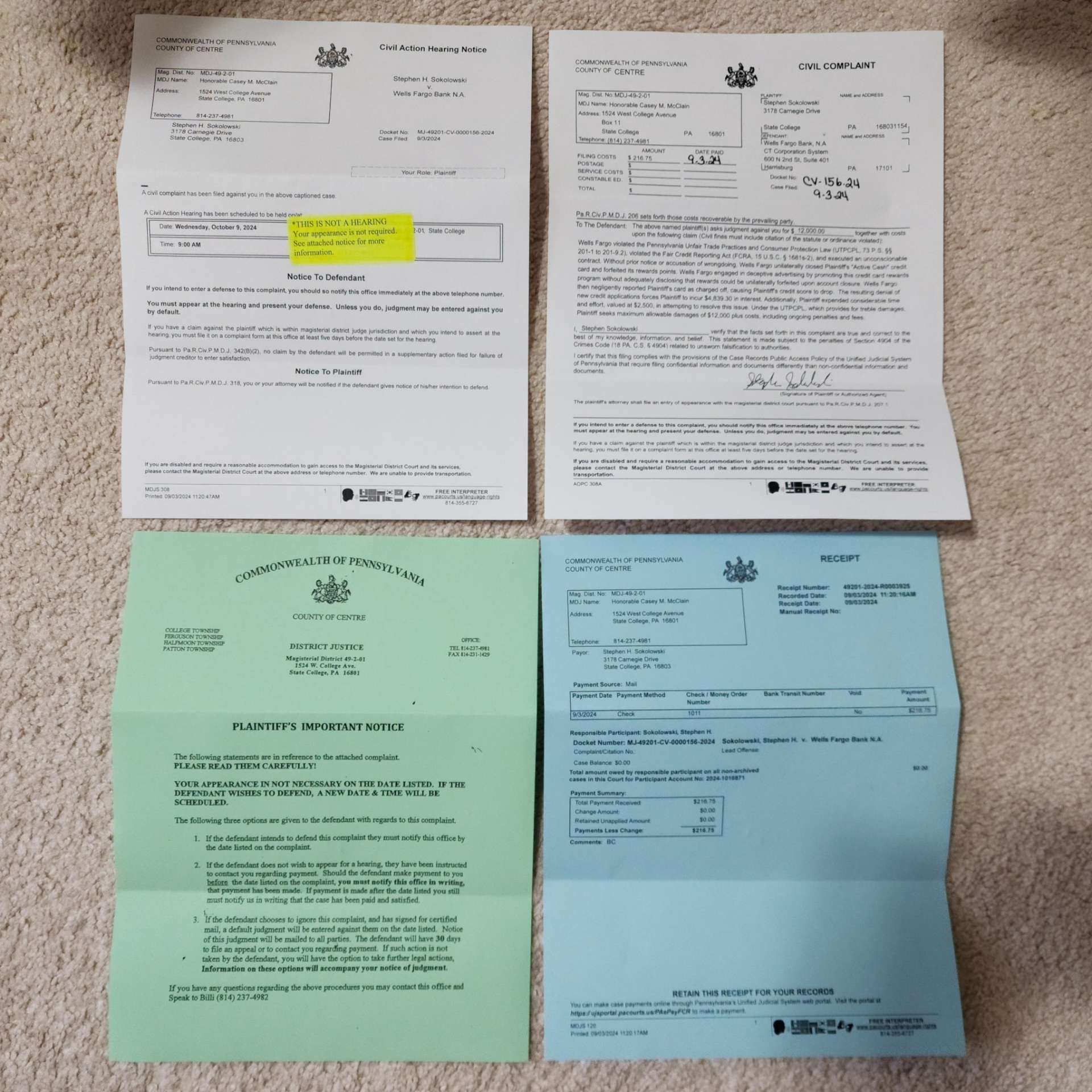

This has not happened in any of the five previous cases. I will pay the fee and ask the sheriff to serve them in person.

2024-09-28:

It turns out that the reason that they could not be served was because they were now registered at a different address.

I paid them to serve the different address. They returned the check, saying that because it was a different address, the check had to be made out to a different entity that differed by one number, the amount was a few dollars more, and the case may be transferred to a new judge because the address is across the street. So, I resent a new check yet again and we'll see if this is rejected.

The frustrating part is that there does not appear to be a public explanation posted online as to why these fees differ, what they exactly are, and why the checks are required to be different and rewritten. I'll update again when this is finally served.

2024-10-29:

Wells Fargo decided to show up in person and defend the case.

A hearing was scheduled for November 14 at 2:00pm EST. I'll attend the hearing and provide an update after it concludes.

2024-11-01:

Their attorney entered his appearance and the docket is now updated at https://ujsportal.pacourts.us/Report/MdjDocketSheet?docketNumber=MJ-49201-CV-0000156-2024&dnh=MglQW8BeFkUK%2F0vUd%2BobZw%3D%3D.

2024-11-12:

The defendant will be attending the hearing/trial on November 14. I spent 25 hours this weekend preparing the case, and printed 220 pages of evidence.

I will be putting a rehearsal video through Gemini-1.5-Pro-002 to get its thoughts on what can be improved. This market has also fallen so far that I will be exercising my right to buy YES shares, given what I've learned about the evidence so far.

2024-11-13:

Wells Fargo removed the case to Federal court.

As a result, I'll be hiring an attorney and seeking higher damages given there is no jurisdictional limit. I probably will comment even less, now that the stakes are raised. As I will continue the case, the market has not been resolved either YES or NO.

The market will remain open and will be judged according to the outcome of the Federal case. The next action on the case should be expected to be in January 2025.

2024-12-08:

I stated, but should not have stated, that this market would close after 30 days if the case was dismissed for any reason and not refiled within that time. It seems unlikely that this arbitrary timetable will be met, I am not going to change my strategy to meet it, and the market is likely to be resolved to NO for that reason.

This is somewhat fortunate, because I need to get rid of this market anyway. It is no longer serving my original purpose of evaluating the case's merits. There are some people providing erroneous information in the comments. The people betting here no longer have all the facts. The case has become more complex than it was at the outset. And, there is other unrelated litigation I will be focusing on as well now.

My suggestion is that someone other than me, if they still want to bet on this topic, should create new markets - one on whether I get money from Wells Fargo, one on other litigation that might be filed, and whatever other prop bets they want. They can follow the court dockets in the MDPA to inform themselves about ongoing lawsuits. That allows them to continue with the betting and also allows me to stop publicly commenting on the litigation.

Good luck on your betting, and depending on whether I continue the case before or after the 30 day window, this market will soon resolve!

2024-12-22:

This market will be resolved to NO, as I don't expect any action from me in the courts until December 30. While the 51-page complaint is largely complete, I want to re-read the entire Federal Rules of Civil Procedure over Christmas for a second time before filing it. I also want to scan court dockets in one more state, which will take one night. Unfortunately, this market had a 30-day resolution window placed upon it and that time has elapsed.

I will not be opening a new market based upon the upcoming action; however, I will be bringing online a blog. This blog will discuss the AI usage in the case, and how o1 pro is being used to allow pro se litigants to be able to achieve justice in a situation where they could not otherwise have afforded to. The blog will not discuss the factual aspects of the case and will not respond to comments from the "armchair lawyers" in this market. They are welcome to create a new market on that case when it is filed if they wish.

You can keep an eye on the Middle District of Pennsylvania's docket. Good luck!

@KevinBlaw will be sorry to hear that the case is continuing towards a final resolution in my favor. Yesterday, Wells Fargo charged off $17,500 in debt on a different card, which they are no longer attempting to collect. While the money has resulted in some mitigation, the chargeoff itself compounded the damages.

I'll continue to provide future updates as events progress.

@SteveSokolowski I’m not sorry about what happens in the secondary debt market. However, I do look askance at you for having such a high credit card debt. Just be glad you aren’t getting a 1099-C

What does any of this have to do with litigation?

@KevinBlaw I already told them explicitly that if they send a 1099-C, I will sue. That's in their records. We will see what they do next.

Other than that fact which is known to them, I'm not going to comment on litigation strategy, as I said earlier. There are significant additional damages here under the UTPCPL. They falsely advertised their "Cash Rewards" program and I relied on their false advertising when signing up for that card.

@SteveSokolowski well until you win lawsuits, your bragging is premature. I am confident Wells Fargo has not acted any differently towards you because of them beating you in court like a rent boy.

@SteveSokolowski credit card companies charge off debt literally every day. You aren't special. They aren't afraid of you. The world doesn't revolve around Sokolowski believe it or not.

@KevinBlaw Yes, I am special, in this particular instance.

I don't know why you spend your time degrading other people - what is wrong with you? When I criticize something, I do so in a polite way so as to respect the person offering the comment.

You are not the type of person I want to associate with, so I've decided to block you. I will spend my time with those who care for others.

@benjaminIkuta The Wells Fargo situation is still underway. I'm expecting more news by 2027, but this probably won't end until 2029. I'll keep you updated.

@benjaminIkuta This is how long litigation takes. I expect the lawsuit against DCG and the others to also last into the next decade.

Right now my strategy is to wait for Wells Fargo to take the next action, and I'll go from there.

The complaint has been filed. https://shoemakervillage.org/temp/complaint_as_filed.pdf.

It's against different defendants, so it would not have resolved this market to YES. The case that this market was dependent upon remains outstanding.

@benjaminIkuta I'll summarize, it's AI garbage, worth zero dollars as a filing, and is subject to sua sponte dismissal.

@benjaminIkuta I'll point out that this user seems to think that courts do everything on their own without arguments made by anyone, so I wouldn't take his word for it.

@SteveSokolowski I think it's fair to ask, what will it take for you to acknowledge you're wrong, and you can't accomplish anything by being a serial pro se litigator? This case getting quickly dismissed too? How many others?

@FrederickNorris You're obviously not having a discussion with me in good faith, so I'm not going to continue talking with you. @KevinBlaw is now being reasonable and appears to have actually read the complaint, while you're just spouting nonsense.

I decided to block you because you aren't actually providing value based on the merits. I wish you the best of luck.

@SteveSokolowski I'd appreciate a comment here once this is all over. I was believing in your persistence.

@Primer The resolution of this market is solely based on the resolution criteria, which the armchair lawyers successfully twisted to their benefit. It should not be viewed as dispositive to this case or any other, and you can review the docket yourself to keep informed of any future updates.

@Primer He will never win any case on any timetable, it was totally unreasonable to keep a market that started with a small claims filing open for 4-6 years, like he's now claiming it will take him to win (which is ludicrous, btw).

@Primer This is going to be my last statement on this matter for now. As I said, you can watch the docket in about a week. But I will explain what's going on here.

This market was intended to inform me on the odds as the case progressed. However, as this case has escalated, all of the information required to make an informed decision by external observers is not available. So, this market was no longer fair.

Second, the armchair lawyers are spewing out nonsense, and I stupidly agreed to close the market after 30 days. 30 days is not a meaningful number related to the market, but it had been agreed upon.

Finally, o1 pro is now available, and it is superintelligent, and there is no need anymore for me to use humans to analyze the strength of a case in this manner, so in many ways I am glad to be rid of the market. I suspect that o1 pro has implications for Manifold's utility in general, especially as the context windows grow in size.

I apologize for this "30 day" confusion; I would recommend not listening to anything these guys below are saying. At least half the things they are saying are lies. Best of luck!

@SteveSokolowski @Primer We went from him saying "This will be settled before October 2024" to saying "This will take 4-6 years of my full time effort to get money from EDITED: all of my pro se cases" which will never happen, notwithstanding whatever improvements to ChatGPT that he's relying on.

Here's another gem from the MC "Wells Fargo removed the case to Federal court. As a result, I'll be hiring an attorney and seeking higher damages given there is no jurisdictional limit." You know why he didn't follow through with this promise? Because he likely heard the same advice as he did from the armchair lawyers: get over these canceled accounts, and move on with your life.

TAKEAWAY: Pro se litigants don't make money. Canceled credit cards/closed bank accounts don't equal money. MC is ignoring the real people in his life, who presumably care about him, and are giving him the correct advice. Decision points like this are why some people succeed, and others fail.

@SteveSokolowski Sorry for the confusion. I wasn't trying to dispute anything. I certainly won't follow any legal proceedings, was just hoping for a "This would have resolved Yes/No" sometime.

@FrederickNorris I didn't say that I would devote 4-6 years of full time work to Wells Fargo's case.

I would appreciate your editing and removing that false statement - and I mean immediately - thanks.

@SteveSokolowski Giving your interpretation the benefit of a doubt, I did change this to "all of your pro se cases" not just the Wells Fargo case, which is equivalent to me. But I made this edit at your insistence.

@SteveSokolowski I'm not trying to deliberately provoke you, but either scenario is equally bad for your life, Stephen. Have you generally researched the effectiveness of pro se litigants? The wisdom of Mark Twain still applies to this day.

@SteveSokolowski You are complaining about "precision" when according to your lawsuit Wells Fargo "does not mention in a prominent position that the company may forfeit rewards unilaterally." So, they were precise about what they were gonna do, but the precision wasn't PROMINENT enough. LOL