Will Tesla be the car company which sell the most cars by the end of 2027? (We need to wait until financial results from the biggest automakers)

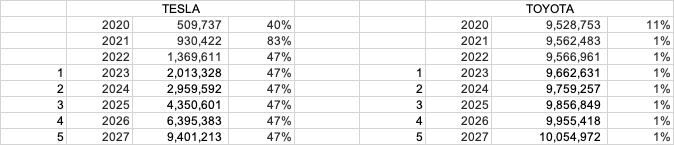

I believe this is highly unlikely. In 2022, Tesla sold 1369611 units while the top-selling car manufacturer sold 9528753 which is almost 7 times more than Tesla. In an exceptionally positive scenario for Tesla, I have considered its latest growth of 47% on a linear basis for the next 5 years. For Toyota, I did the same and assumed a linear growth of 1%. As evidenced by the calculations, even if Tesla achieved a 47% growth each year over the last 5 years, it will still be short of becoming the biggest car manufactured by 2027 (Toyota).

I don't think it will happen, in fact, this question can be put in another way, that is, whether electric vehicles will dominate the market before 2027, I think that although electric vehicles have made progress in the past few years, and Tesla has surpassed many traditional automobile manufacturers, however, there are still some technological bottlenecks and challenges for electric vehicles. For example, limitations in battery technology, insufficient charging facilities, and problems with battery recycling. From the perspective of market demand, fuel vehicles still have a large market share. In some regions and consumer groups, fuel vehicles still have an irreplaceable position. For example, in areas with insufficient coverage of gas stations, charging facilities for EVs may become a bottleneck for their development. In addition, infrastructure development is also an important factor in the popularization of EVs. Infrastructure such as charging piles and charging stations require substantial investment and construction time, especially in some old urban areas and rural areas, where the construction of charging facilities is difficult. It is difficult to produce a breakthrough on the above issues in the short term unless there are major technological innovations.

@YueChen I disagree with the comment:

· Record demand and order backlogs: The company has an immense number of backlogged Tesla orders making for unprecedented demand levels on the company. For example, many people on one year’s wait list are trying to purchase Tesla’s electric car, and it appears people desire it.

· New Production Plants in Germany and Texas: More specifically, two newly established plants of Tesla in Germany and Texas will provide for increased production. The long-term margins will be well built for this company’s profitability beyond this stage on the sustainability of long-term automotive margin of over 25%.

· Strategic Supply Chain Advantage: In some respects, like semiconductor batteries, Tesla has a competitive advantage with a few of the important supply chains. One of such areas is a bottleneck for industry called “batteries” and thanks to internal battery technology by Tesla in production process and raw material sources like lithium it has advantage over other competitors).

· Stock Selloff and Challenges in 2022: The Company’s outlook is bright but this stock went down by 38% last year because of factors like lockdown of China leading to suppressed demand and technology problems.

· Sales Growth and Expansion Goals: Tesla plan to sell and deliver about 1.4 million cars in 2022 which is a rise of at least 50% growth on an average yearly basis.

· Elon Musk's Leadership and Ambitious Plans: With CEO Elon’s vision out there, the optimism is boosted through his plans of making more affordable electric vehicles in large volumes.

· Projection for the Top Three Global Carmakers by 2030: By the year 2030, Tesla would easily be a part of the elite threesome leading by the increase in sales and market value. It reveals that Tesla can take over the conventional makers.

Tesla might not become the top-selling car manufacturer in 2027 due to potential challenges in scaling production and meeting global demand. Existing competitors have well-established market shares, diverse product portfolios, and expansive manufacturing capacities. Additionally, the continuous evolution of electric vehicle technology is likely to intensify competition, making it difficult for Tesla to secure the leading position within such a short timeframe.

Tesla is a top-selling manufacturer now, but this may be different in the next years.

Tesla's CAGR for 2027 is 2.72% = $29bn (Statista)

EV vehicles CAGR for 2027 is 17.8% = $1,579bn (Finance Yahoo)

At least 40 automakers are EV makers in China. They have measured an increase of 93% in EV sales in one year. (ABC News)

Chinese brands are making similar and cheaper EV cars and they offer much more range and autonomy. A better adaptability for people in rural environments. (Energy 5)

Tesla has maintained a strong presence in the electric vehicle market for a while, but Chinese electric car manufacturers are rapidly closing the gap and have the potential to significantly impact Tesla's position.

Tesla will be beaten by new technologies like hydrogen cars, or other car companies who are coming up with technology and affordability factors. The pricing that Tesla offers, makes it a specific market target product and there will be a competitor who might offer all these along with great features.

Companies like Toyota, BMW, Honda are already in line of developing cost effective Hydrogen cars which are faster and works efficiently in comparison to Ev's.

Reference : https://www.businessinsider.com/hydrogen-fuel-cell-cars-teslas-biggest-threat-2019-12https://finance.yahoo.com/news/hydrogen-electric-vehicles-outperforming-evs-154504836.html

https://www.fastechus.com/blog/vehicle-manufacturers-working-on-hydrogen-fuel-cell-vehicles

From my own perspective, the electronic vehcile is dominating the market of the traditional gas auto. Due to the rising price of the gas and the technology of EV is getting better by the time. In the future, because of the international situation, the price of gas won't decrease and the inflation is getting worse, more people will chose the EV as their daily vehicle for the shcol or business. The Tesla is the dominator in the EV market, it has already become the top-selling car manufacturer, it will just get better than today.

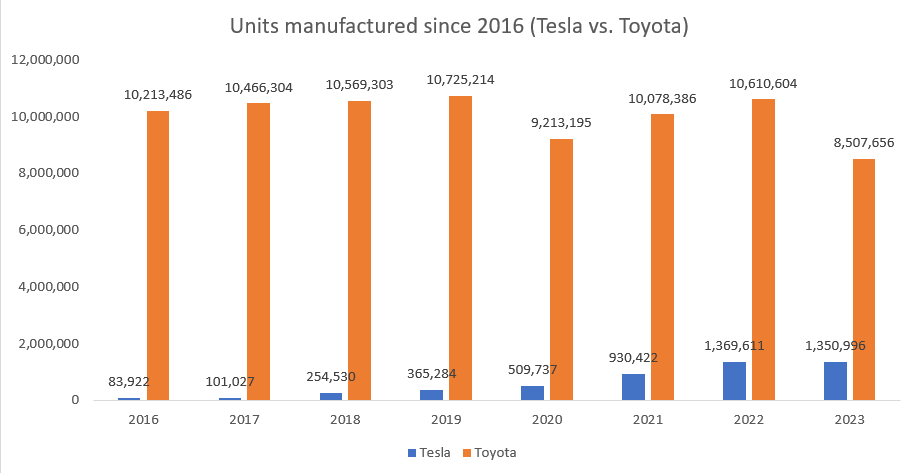

Personally, I see TESLA surpassing many car manufacturers and becoming one of the biggest, but I think 2027 is too soon for that to happen. If we see TOYOTA that is the biggest right now with 10.5+ million cars sells in 2022 compared to 1.3 million form TESLA. There's a big movement of the market towards EV (Electric Vehicle) which TESLA has been the best company that has tackle this market, but TOYOTA has been investing heavy amounts of money into EV vehicles and also have experience and more resources. They created their first EV in 1997. Apart from this the majority of the world is still using gas powered vehicles which TESLA does not produce. Lots of countries have joined force to start banning gas powered cars but the majority of these are for 2030 and not 2027. Apart from this is very hard that the biggest car manufacturer right now Toyota will not be able to hop on this new market trends since they have experience so much before and are investing big time into EV market. Furthermore, Toyota's target market is broader, Tesla's is more narrowly focused. Tesla aims to attract customers who are prepared to shell out more money for a high-performing, green vehicle. Even if the market for EVs is expanding, Toyota is aiming to attract customers who are searching for a reliable, reasonably priced vehicle. This is a larger target group than Tesla's current demographic. So, no I don't think TESLA is going to be the top-selling car manufacturer in 2027 maybe in the future.

@SebasPrieto Agreed with your perspective. In addition to your perspective, in terms of revenue, Tesla is at 11th with approximately $94.03 billion of revenue (according to Yahoo!finance portal), below manufacturing some giants like Hyundai ($118.37), Honda ($129.18), Toyota ($286.15 Billion), Ford ($169.82 billion) and Volkswagen ($318.32). For 2027 there are only 4 fiscal years left, which indicates that if Tesla was to become #1, it will have to multiply its revenues 3.39 times to even match Volkswagen.

Let’s compare Tesla’s numbers with Toyota’s just to get an idea of the effort Tesla must make to surpass some of its competitors. After some research, the following graph provides an estimation of the sales of both companies between 2016 and 2023 (up to september), if you look closely, even though Tesla has increased its sales (approx. 16 times) over the last 8 years, the reality is that they produce 7 times less units than Toyota. In this matter, I consider that 4 years is not a timeframe big enough for Tesla to close this gap and surpass its competitors at the top. Given the tendencies you point out in the market, it is a matter of time that Tesla becomes #1, but there is a long way to go.

Sources for data

For revenues:

https://finance.yahoo.com/news/top-20-biggest-car-manufacturers-121612000.html

https://www.insidermonkey.com/blog/top-5-biggest-car-manufacturers-by-2023-revenue-1206910/2/

For graph's datasets:

https://www.statista.com/statistics/715421/tesla-quarterly-vehicle-production/

@SebasPrieto I agree with your thought, in addition, I would like to share some comments from production perspective.

The present restrictions on lithium supply have an effect on EV sales as a whole and provide obstacles to Tesla's goal of overtaking the competition. With only 82,000 metric tons of lithium mined annually, a hypothetical global lithium production dominance held by Tesla would limit its annual car production to 6.8 million units, leaving no lithium left over for other necessary devices like laptops, phones, and power walls. Each Tesla car requires approximately 12 kg of lithium. Even if there are 80 million metric tons of lithium reserves in the world as of 2019, this is still a constraint.

Furthermore, Tesla and the larger EV sector face financial difficulties due to the predicted stagnation in battery pricing. According to Bloomberg, this scenario will make it challenging for Tesla to compete, particularly when other big automakers create cars at a much cheaper cost, which will make it more difficult for Tesla to appeal to the mass market.

Competition highlights Tesla's uniqueness to electric vehicles, making it a niche player. In contrast to their more diverse automotive equivalents, competitors that serve a wider market add complication to Tesla's growth trajectory.

Sources for data

@BrianCaulfield of course worldwide 😅 why would I think about 1 country out of all countries in the world?

@BrianCaulfield but thanks for your comment as an opportunity for clarification. But a non-US citizen it was obvious ☺️

@Mikelon797 You'd be surprised lol.

You'll be compiling the big auto-makers' sales data yourself? Just imagining edge cases, sales data might be for fiscal years, though if it's broken down by quarter you could reassemble it into the calendar year.

@chrisjbillington yeah, i'll get the data for the fiscal year, that it why i wait until Q1 2024. I'll try to get the most reliable source of information for the numbers :)