Original Lesswrong thread here.

Original tweet here:

Unlinked market with shorter timeframes here: /Joshua/when-will-we-know-that-any-past-ufo

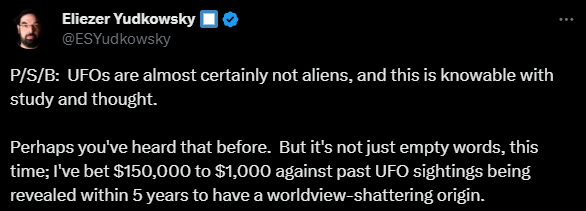

@RenaoJedi Yudkowsky initially and the lesswrong community if disputed: https://www.lesswrong.com/posts/t5W87hQF5gKyTofQB/ufo-betting-put-up-or-shut-up

I don't see how he could win this bet, as it's not like anyone could bring conclusive proof against aliens any more than anyone has been able to bring conclusive proof against anything supernatural. Hell, even natural incidents can be devilish to settle— see the endless arguments about JFK's death.

@guiltybystander The bet has a 5-year time limit (from the date the bet was made in July 2023) and the terms are such that Yudkowsky only loses if strong evidence comes out during that time that UFOs are caused by aliens or supernatural entities or something else that would cause "a significant ontological shock". If no new evidence for or against this comes out before the deadline, Yudkowsky wins the bet.

The evidence is starting to significantly stack up against this.

https://x.com/drbeavillarroel/status/1980253179817464108?s=46

@CodyZervas I didn’t really understand that well enough to judge it as significant evidence or just the equivalent of replication crisis research. Or even if it means anything if it’s super valid in every way.

Out of curiosity, I took a look at the linked paper.

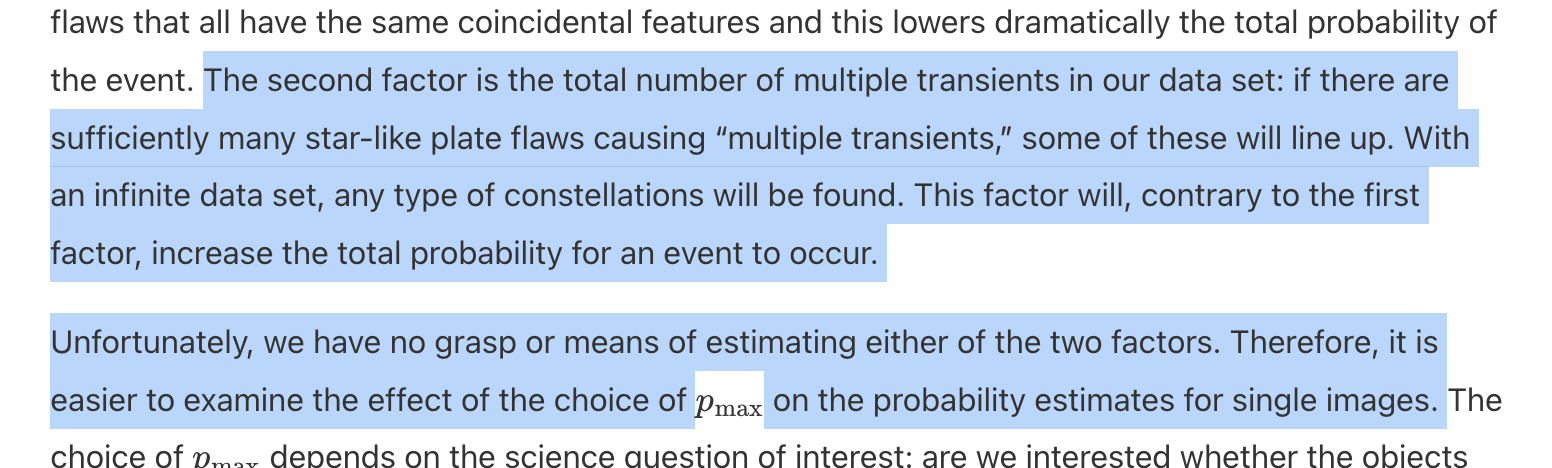

I didn't read it deeply but the main question in my mind was something to the effect of - surely if you take a lot of photos and there's some noise, you might have interesting-seeming arrangements of noise by chance. This appears to be the paper's response to that question:

I don't know if this is a knockout as there are "only" ~2k photo plates in POSS-I and there's other argumentation in the paper beyond the likelihood of 'transients' lining up, but it's not clear to me why you can just... ignore this concern as they do here

@draaglom ya I also saw the twitter post and read the paper yesterday... my impression was similar:

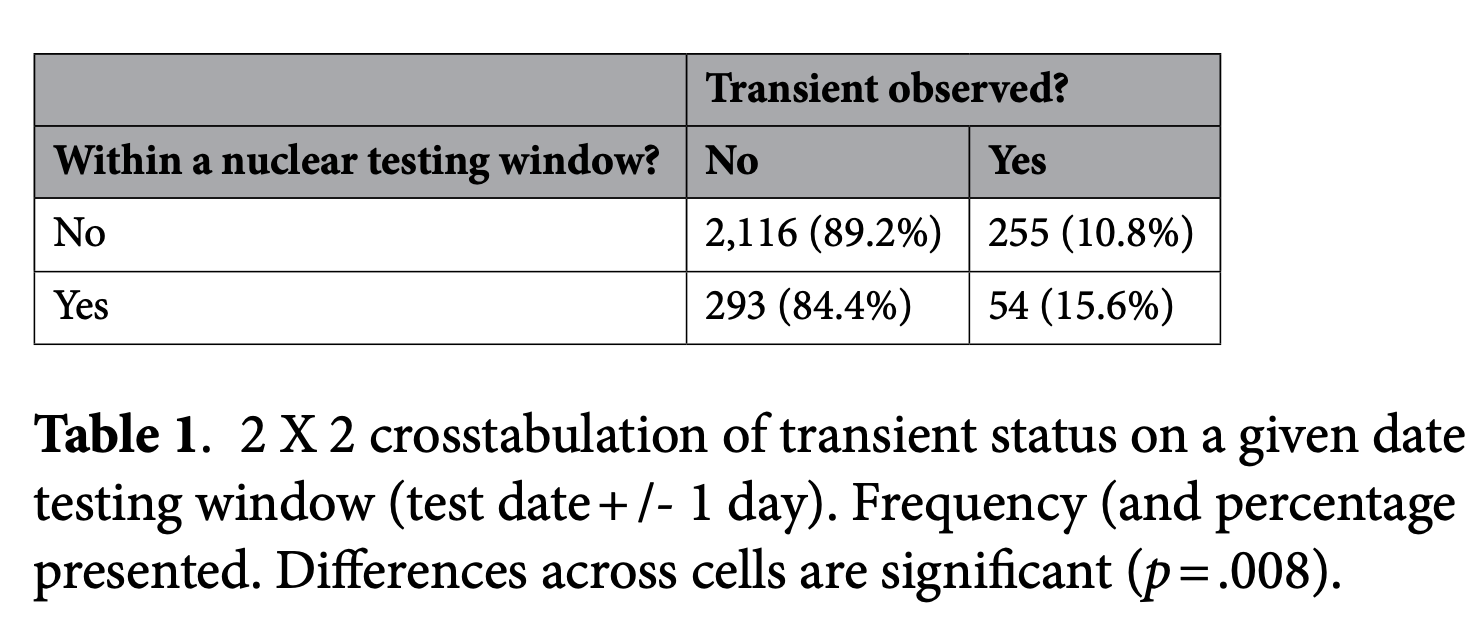

The p = 0.008 seems suspicious here. I'm not sure how they arrived at that conclusion, but the difference between 10.8% and 15.6% is not as marked as I'd like to see, and I don't know whether their statistical analysis is treating clustering effectively?!

On top of that, the +/- 1 day thing strikes me as extremely suspicious. If the thesis is something like "nuclear testing triggers transient obsevations," then why the heck would that happen 1 day BEFORE a nuclear test? There are just too many research-degrees-of-freedom here.

@draaglom on top of all this, I'm not even sure the correct conclusion, were this paper correct, would be "nuclear testing --> UFO activity."

The more intuitive explanation would be "nuclear testing --> launching dirt into orbit creating transients visible to observatories"

@bens The UAP hypothesis would have to include some sort of surveillance anticipating the test, which increases its komolgorov complexity (further from default occam). I think this paper is more of a hypothesis-generator than something conclusive. If it really does stand up to tougher scrutiny, (there are more tests to be done on this data) we then need hypotheses to explain the phenomenon.

@JonatanArvidsson the fact they see them in a line is consistent with it being debris following a trajectory.

@CodyZervas It could have been caused by short-lived reflective structures in the upper atmosphere or ionosphere, formed as a result of nuclear explosions.

@bens also a good remind to follow ppl I like on here… I forget this is also a social media platform

I try to follow good traders and interesting people

... doesn't follow literally the most interesting man in the world